Project purpose

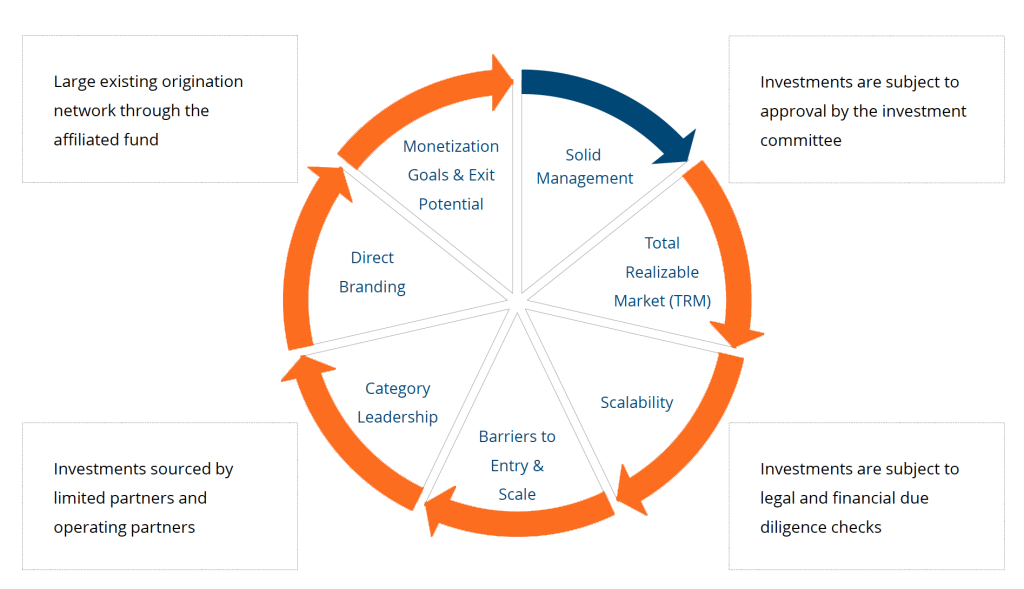

The investment objective of the Project is to establish, incubate and prepare for foreign expansion and subsequent / subsequent financing rounds, 26 motivated to further development, innovative capital companies based on at least two-person teams composed of: "entrepreneur" and "hacker" technologist - possessing global development potential.

We aim to find and implement projects with the highest development potential due to its global reach. Our companies are to achieve readiness to absorb subsequent rounds of capital financing within 12-18 months.

The total value of funds managed by the Manager (RDS Fund Sp z o.o.) including the amount of the subsidy from the National Center for Research and Development is PLN 49,577,200, including the amount of the subsidy from the National Center for Research and Development 39,395,000 PLN, amount paid by private investors PLN 10,217,200. Ultimately, the funds involved in the Portfolio amount to PLN 41 million (acquisition of shares plus subsidies), of which PLN 8.2 million is the expenditure of ASI (ASI RDS Fund limited liability company limited partnership) for the acquisition of shares in Portfel companies.

Project co-financed / financed by the National Center for Research and Development under the program BridgeAlfa.